Markets do remain overvalued across the

investment part of the economy and we may

see normalisation of valuations in some of

these segments.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

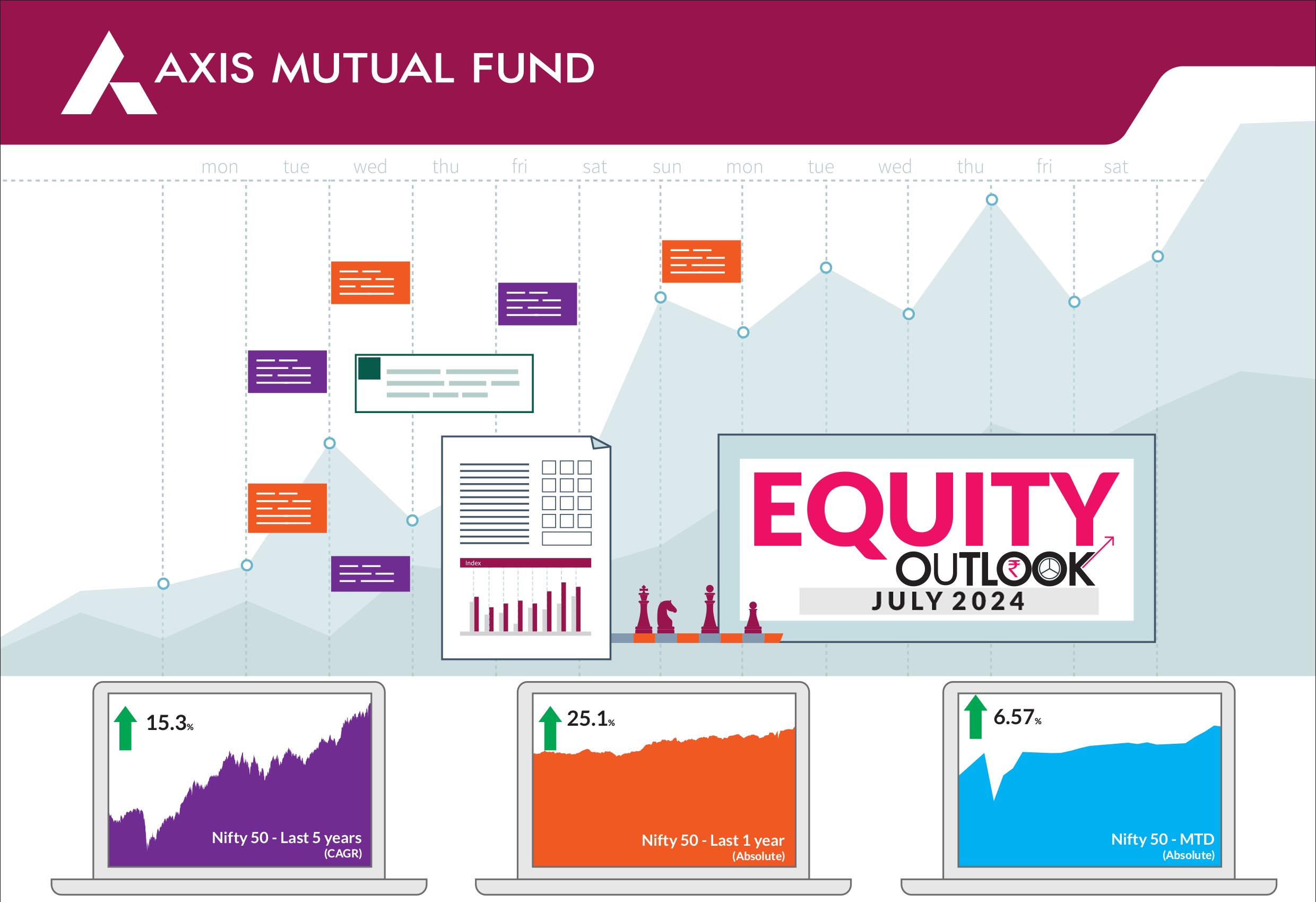

After the initial bout of volatility on the day of electoral outcome, India equites rose notably over the month buoyed by encouraging economic data, robust flows and optimism around the new government's upcoming budget. The BSE Sensex and the NIFTY 50 ended 7% and 6.6% up respectively. Amongst other indices, both the mid-caps and small caps gained during the month. The NIFTY Midcap 100 ended the month higher 7.8% while NIFTY Small Cap 100 ended 9.7% up. The number of stocks trading above their respective 200- day moving averages was higher at 88% in June vs. 73% in May. The advancedecline line was up 13% in June while volatility was down. |

After being net sellers for two consecutive months, Foreign Portfolio Investors (FPIs) bought to the US$3.2 bn while domestic institutional investors remained strong with inflows of US$3.4 bn. For 2024, FPI net buying stood at US$0.4bn, while domestic institutions were net buyers at US$28bn. Pertinent to mention here, that India officially joined the JP Morgan Global Bond Indices on June 28 and this move will lead to phased inflows of US$25-30 bn. |

The most awaited event, i.e., the elections has finally passed. Markets have witnessed runup as well as volatility based on this event. With markets making lifetime highs every month, investors should be mindful of potential market volatility ahead and rebalance their portfolios accordingly. Any declines are likely opportunities to increase exposure to equities. At Axis, we always maintain an asset allocation approach to investing based on investor goals, investment horizon and risk profile with a long term view. Markets remain overvalued across the investment part of the economy and we may see normalisation of valuations in some of these segments. Having said that, India remains one of the fastest growing economies globally. Macros remain strong with an easing inflation cycle, progress of monsoons and robust economic growth. The upcoming Union Budget in July, the earnings season and policy announcements would set the tone for equities in the near term. We expect consumption to pick up going forward and there are little signs of uptick in the rural demand segment. A good monsoon, lower inflation and the festive season could further boost rural demand. In addition, a pickup in capex could likely lead to more job creation and thereby a boost in spending power aiding further consumption growth. The premiumisation theme continues and the beneficiaries are the various segments within consumer discretionary. Automobiles and real estate seen an upswing as did high end retail. The housing sector is seeing increasing absorption pan India and with the government's focus on affordable housing, building materials and ancillaries across the spectrum stand to gain. We retain our overweight stance in these sectors. With the turnaround in capex and a revival in government spending, the entire curve of the capex cycle stands to benefit in light of multiple enablers such as deleveraged corporate balance sheets, healthy profitability, rising domestic demand, and increasing capacity utilization. Accordingly, we are overweight on the infrastructure, manufacturing, utilities and transport. We maintain a bias to holdings in sectors that can benefit from government policies such as energy, defense, power. The banking sector could gain from decadal low NPAs, better capital ratios and a surge in credit demand. In the pharmaceutical industry, we anticipate the favorable pricing conditions to persist and intensify. Conversely, we have an underweight in the export-oriented segment, attributing this to the decline in global economic growth. |

Source: Bloomberg, Axis MF Research.